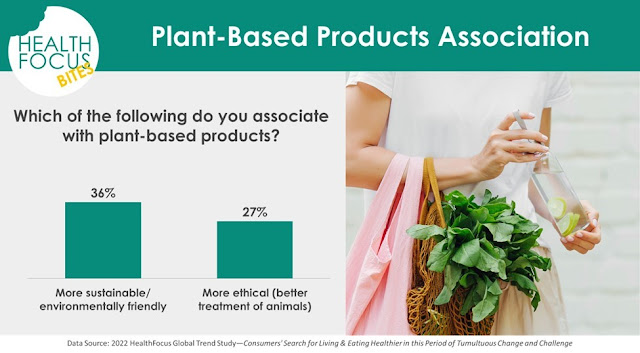

The “power of plant” is strong, with a mainstreaming of plant-based eating taking place before our very eyes; however, it’s no surprise that as plant-based foods become a bigger part of everyday life, consumers have become more discerning. Interest in plant-based products like meat alternatives and plant milks are being met with growing consumer concerns around exactly how healthy and sustainable these really are, according to “The Plant Paradox: Navigating the Complexities of Plant-based Perceptions Around the World” from HealthFocus International.

FMI—The Food Industry Association, just published its inaugural “Power of Plant-Based” report. You can watch a one-minute video with highlights HERE.

The FMI report looks at the whole range of what constitutes as plant based, including naturally plant-based foods, such as fruits, vegetables, beans and whole grains, as well as alternatives to traditional animal-derived items. When looking at this spectrum of products, the study found that two out of five (42%) shoppers put either a lot or some effort into selecting plant-based foods or beverages.

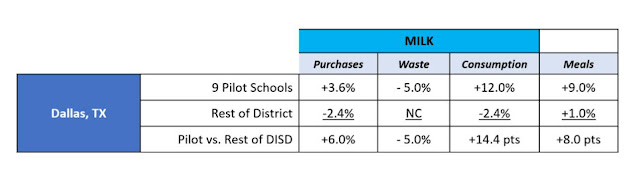

“More than 40% of shoppers at least occasionally eat a meat, dairy or seafood alternative, but dairy alternative sales are more than twice those of meat alternatives,” said Steve Markenson, director of research and insights for FMI. “The plant-based foods most likely to be regularly consumed by shoppers are naturally plant-based: fruits and vegetables (75%) and beans, nuts, or grains (47%).”

A quarter of shoppers regularly consume milk alternatives and 21% regularly consume other dairy alternatives, according to FMI. Slightly less than 20% of shoppers regularly consume meat alternatives. Those who tried plant-based meat and dairy products once or twice but did not continue said taste was the biggest reason.

When asked how they would refer to their type of eating, most shoppers identify as meat eaters, considering themselves to be omnivores (15%) or carnivores (21%). About one in 10 (9%) identify as being flexitarians, while a similar proportion follow approaches that avoid meat, such as vegetarian (6%), vegan (2%) or pescatarian (2%).

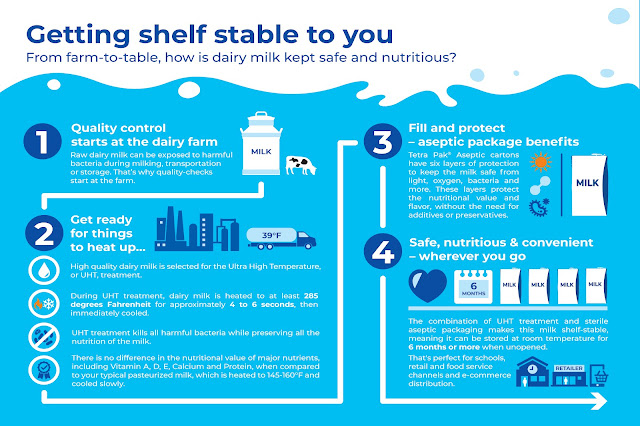

The majority of consumers surveyed include dairy milk (86%) in their diet. Even more include dairy products (94%). That’s what makes products such as Plucky Pickle Dips so attractive in today’s marketplace.

Originally introduced in 2018 as Darling Pickle Dips, Plucky Pickle Dips can now be found in more than 500 stores and Target recently increased its placement. Other major retailers are evaluating the product for placement in their next resets. The refrigerated dip line is made with zesty pickled vegetables, herbs and spices that are mixed into a smooth cream cheese and white bean blend. The cream cheese gives the dips richness, while the pureed beans provide a slightly chunkier texture than most creamy dips. It also bring a decent dose of plant to the product.

The dips were developed by two life-long friends--Sara Doherty and Britt Jungerberg—in their quest for something different and better-for-you in the premium dip category. Darling Foods LLC was one of six dairy companies that participated in the 2018 Land O’Lakes Inc., Dairy Accelerator, a program supporting the dairy industry by providing tailored coursework and mentorship to dairy entrepreneurs. To qualify for consideration, each company was required to utilize dairy as a primary ingredient in their products. This product’s success shows the power of working with an accelerator program.

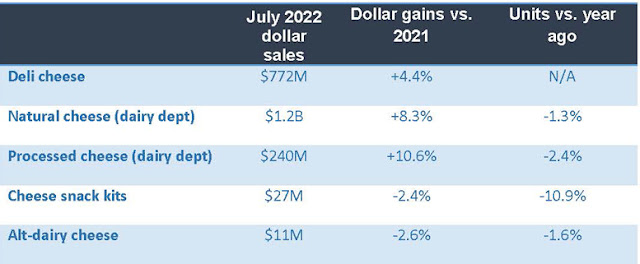

Graph source: FMI-The Power of Plant Based, 2022

“Our ethnographic research suggests consumers are seeking out plant-based foods and beverages primarily for both taste and nutrition,” said Krystal Register, senior director for health and well-being at FMI. “The food industry has an opportunity to provide guidance and educate consumers on overall healthy eating approaches that include plant-based options in alignment with the Dietary Guidelines.”

The FMI research found that curiosity is a major characteristic for shopper experimentation. Millennials are more likely than Gen X and Boomers to put effort into selecting plant-based foods, and nearly half of shoppers buying plant-based foods and beverages live in households making more than $100,000 and have children. Shoppers interested in these foods and beverages tend to have bigger basket sizes, but also shop online.

Graph source: FMI-The Power of Plant Based, 2022

The report found consumption of plant-based food and beverages will likely continue to grow, with nearly one-in-three shoppers expecting to increase consumption “a little,” and 16% expecting to increase consumption “a lot.” Thirty-five percent of shoppers who regularly consume plant-based items said they will consume “a little more” and 27% said they will consume “a lot more” in the future.

The time is right to become a “Flexitarian Dairy Company.” Link

HERE to read more.

.png)