Americans continue to cook more at home than they did before COVID, said Heather Prach, vice president of education for the International Dairy Deli Bakery Association, Madison, Wis., who spoke at IDDBA 2023, the association’s annual tradeshow that took place in Anaheim, Calif., this week. Citing a recent IDDBA survey, she said 50% of consumers are mixing scratch cooking with fully or partially prepared foods when cooking at home, a trend that represents a strong opportunity for in-store deli innovations.

This presents an opportunity for dairy product innovations, too. Think savory sour creams that function as a cooking sauce or pasta salad mixer. What about globally inspired shredded cheese blends? The opportunities are infinite.

To read more about this, link HERE to a Food Business News article I wrote on the topic.

Dairy products have been a staple in American households for a long time, and a recent survey from Atomik for the National Frozen & Refrigerated Foods Association shows this still remains true for the majority of consumers. June is National Dairy Month, and while most U.S. adults (70%) already say the dairy aisle is essential on every grocery trip, there are budget-friendly and alternative options that make the dairy aisle a key stop for every kind of shopper.

“As consumer trends and preferences shift over time, the dairy aisle continues to innovate and remains a constant in U.S. consumers’ shopping trips,” says Tricia Greyshock, executive vice president and chief operating officer at National Frozen & Refrigerated Foods Association. “Nearly three in five U.S. consumers (56%) report that products from the dairy aisle take up half or more than half of the space in their refrigerator.”

Snacks are a very popular choice for consumers shopping in the dairy aisle. The survey showed that most consumers find exactly what they need to snack on. For families with children, almost two-thirds of parents (63%) find their favorite snacks in the dairy aisle.

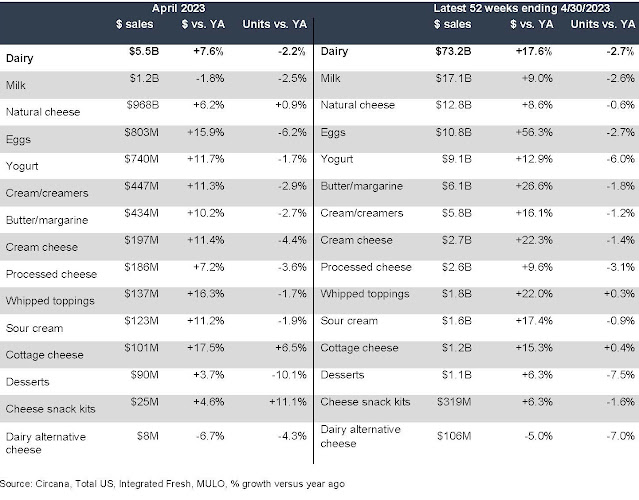

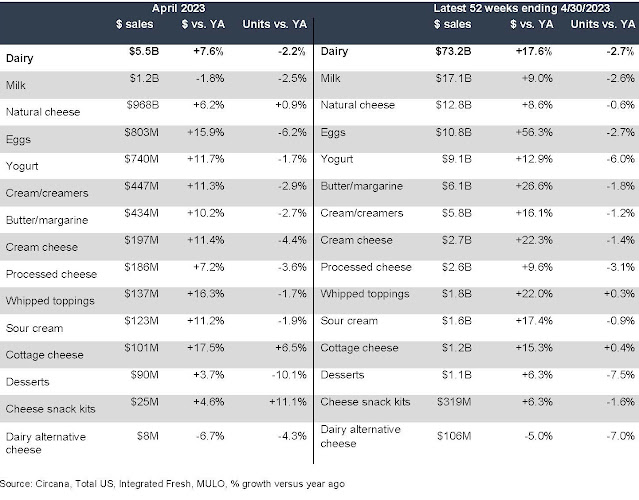

Data from Circana shows that total retail dairy dollar sales were 7.6% higher in April 2023 than April 2022, but this was from inflation. Unit sales were down slightly, at -2.2%. Several categories accomplished unit growth in April 2023 versus April 2022, including natural cheese, cottage cheese and cheese snacks. Only two areas, milk and plant-based dairy alternative cheese, lost ground in both dollars and units.

Yogurt is picking up momentum as more people return to the office and pack a yogurt snack. Yogurt manufacturers are also starting to, once again, get creative in this space after focusing on keeping shelves stocked since the onset of the pandemic.

Indeed, Americans are snacking and yogurt is one of their favorites. They are snacking frequently for a variety of reasons and are reaching for new options. 84.51 degrees, the Cincinnati-based data powerhouse that helps Kroger and its partners create customer-centric shopper journeys, polled shoppers about their snack habits and buying intentions.

They found that younger consumers snack the most frequently with 74% of those under 35 years old snacking at least a few times per day. Fifty-six percent snack all year round, but colder months warrant the most snacking behavior, with 34% of consumers saying they snack most during the winter. Sixty percent claim they snack the same throughout the week and 28% snack more on the weekend.

More than half (53%) of those surveyed snack on yogurt. Consumers are also reaching for yogurt, granola bars and protein bars as meal replacements.

The most important factors to consumers when snacking:

- Taste/flavor: 72%

- Fulfills a craving: 62%

- Curbs the appetite: 48%

- Convenience: 44%

Snackers between the ages of 18 and 34 are the most willing to try new snacks (60%), and decide on trying new snacks depending on if it’s on sale (59%), if the flavor is appealing (58%), if they have a coupon (51%) or if a friend suggested they try it (49%).

Findings from a separate study by 84.51 degrees showed a higher percentage of customers saying loyalty is on the rise. The brand/customer relationship has evolved and it’s important for brands to give customers a reason to remain faithful.

Three trends uncovered by the research:

1. Customer definitions of brand loyalty have changed. While shopper perceptions of brand loyalty have changed and there’s is no consensus on its definition, in most shoppers’ minds it has shifted away from exclusivity. One key shift is that shopper loyalty does not guarantee brand purchases. Nearly half (43%) of respondents perceived brand loyalty to be based on preference; more than 30% defined it based on their purchase behavior and 24% defined it based on consideration.

2. Customer expectations and values have shifted. Research uncovered changes in customer expectations that have altered the dynamics of brand loyalty to different categories. While shoppers are motivated by price, brand trust and value are also important. Shoppers across the economic spectrum are looking for opportunities to stretch their budgets. Pinched by high prices, 62% of shoppers said getting a “good value” for their money is important when it comes to selecting a brand over competitors. The second most important quality is trust; 34% said they choose brands that they trust.

3. The brand-customer relationship has evolved. Today’s customers expect brands to be thoughtful about the interactions they initiate with them. A brand’s efforts to engage the customer will be perceived as self-serving if the customer feels like a target, not a person. As a result, even brands that enjoy a high level of loyalty need to give customers reasons to remain faithful.

It's Dairy Month! Be proud! Give consumers a reason to keep coming back to the dairy department.

No comments:

Post a Comment