Valerie Oswalt, president of Campbell Snacks, spoke at Groceryshop, which was held September 19-22 in Las Vegas. She shared that over the past two years, Campbell’s eliminated 577 SKUs, which was 16% of its portfolio.

“This allowed us to free up line time to innovate and provide excitement,” she said, referring to the company’s efforts to be active in the limited-time-offering space. “LTOs are about providing an elevated experience. Think of them as the core product with a plus.”

At that same meeting, c-suite executives from almost all retail chains, along with a fair share of CPG brands, were put in the hotseat for 10- to 20-minute interviews to share insights and plans for the future. To read about “Three CEOs forecast the future of retail,” link HERE.

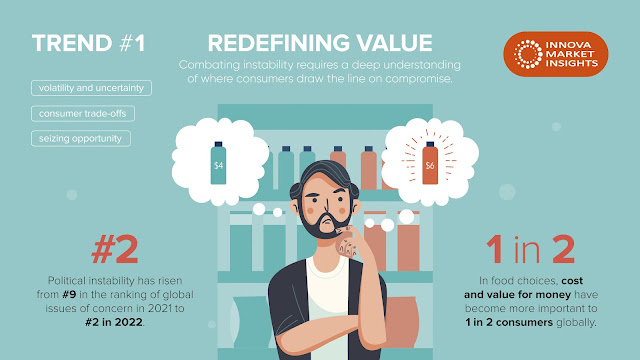

My ongoing meta-analysis of consumer research confirms a message I communicated again and again as a keynote speaker at the QCS Purchasing Cooperative Annual Conference in San Diego earlier this week. And that is that consumers want to be in control and right now they are focusing on controlling how they spend their food dollars. They are in the process of “Redefining Value,” per Innova Market Insights’ Top-10 Trends for 2023. With budgets stretched and supplies under strain, brands need to be flexible in action and open in spirit to connect with consumers.

Today’s shoppers are increasingly exploring money-saving strategies, such as choosing lower-cost items and cooking from scratch. But they remain determined to sample new experiences, ensure personal well-being and support planetary health. There is more pressure on brands and manufacturers to deliver value while still meeting these wider public expectations.

“Redefining value throughout the food and beverage industry will lead in 2023 as consumers seek brands that listen, understand and respond to their core values,” according to Lu Ann Williams, global insights director at Innova Market Insights. “They want brands that provide quality, trust and confidence via their product formulations, communications and wider sustainability actions.”

It is paramount that you understand where your customers draw the line on compromise when it comes to value. As the cost-of-living crisis continues, brands can achieve success through actions that combine economic benefits with clear health and sustainability goals, according to Williams.

“Consumers’ expectations of brands are probably higher than ever,” said Andrew Wardlaw, chief ideas officer at MMR Research. “Every purchase your customers make is going to be more scrutinized than ever, and expectations from your product are most likely to be higher than at any other time.

“Brands must think about strategies that help build the more distinctive, less substitutable product experiences of the future,” he said.

The number-two trend according to Williams is “affordable nutrition.” Shoppers are turning their attention to simple but nutritious foods that are affordable. Key behaviors include buying in bulk, opting for private labels, cooking from scratch, reducing spending on luxury items and purchasing fewer items. Consumers are actively looking for affordable ways to maintain a healthy diet, offering brands many opportunities to test their capabilities to new limits. To meet the nutritional, environmental and economic demands of consumers, manufacturers must innovate to extract maximum value from raw materials and the production process.

No comments:

Post a Comment