As a food and beverage trend tracker for nearly 30 years (yes, I started as a toddler!), I think I know a few things. One is that the sweets and snacks categories are the places to go for flavor innovation for what’s next in ice cream.

It took a week for me to recover from the Sweets & Snacks Expo held in Chicago May 24-26, and now I am ready to share my observations. Let’s start with some innovation winners.

The Best in Show for the annual Most Innovative New Product Awards was Trü Frü LLC, for its Natures Strawberries Hyper-Chilled Fresh in Ruby Cacao. The Best in Chocolate winner was Lindt & Sprüngli (USA) Inc., for its new Lindt Classic Recipe OatMilk.

OBSERVATION #1: Ordinary chocolate just doesn’t cut it anymore. Consumers are interested in premium and unique, and yes, vegan “milky” chocolate.

The winners of this contest set flavor and product trends across the confectionery and snack industries and beyond, most notably ice cream. These products have been developed during the past year and are now available on store shelves or will be made available to shoppers in the coming months.

“Innovation puts the candy and snack categories in the driver’s seat when it comes to flavor and product trends, and the 2022 Most Innovative New Product Awards continue to highlight those that accelerate us into the future,” said John Downs, president and CEO of the National Confectioners Association. “Consumers have been making life at home a little more enjoyable over the past two years by incorporating their favorite treat or snack into their lives in a way that has brought a variety of new flavors and fun to their daily routines.”

Andrea Montreuil, CEO,

INNODELICE, said, “With both large and small brands consistently emerging and innovating in this space at a high rate, ice cream and frozen dessert businesses need to establish their true point of differentiation early on in order to drive sales at a sustainable rate.”

Another reason why it is important to be on top of trends in ice cream innovation is inflation. Grocery shoppers are feeling the pinch on their finances. To learn how rising prices are affecting grocery planning, 84.51degrees, the Cincinnati-based data powerhouse that helps Kroger and its partners create customer-centric shopper journeys, polled shoppers about their buying intentions. When asked how they’re coping with grocery store price increases, 52% of shoppers said they’ve noticed price increases in snacks and candy. While that’s significant, they’re much more aware of rising prices in the dairy (82%), produce (78%) and deli/meat/fish (77%) categories. Two in three shoppers (64%) said they’d cut back on snacks and candy “if money was tight.”

But they are still snacking away. Here’s why. More than half of shoppers (59%) said “satisfying a craving” draws them to snacking, while 74% said “taste and flavor” are more important than curbing their appetite (46%).

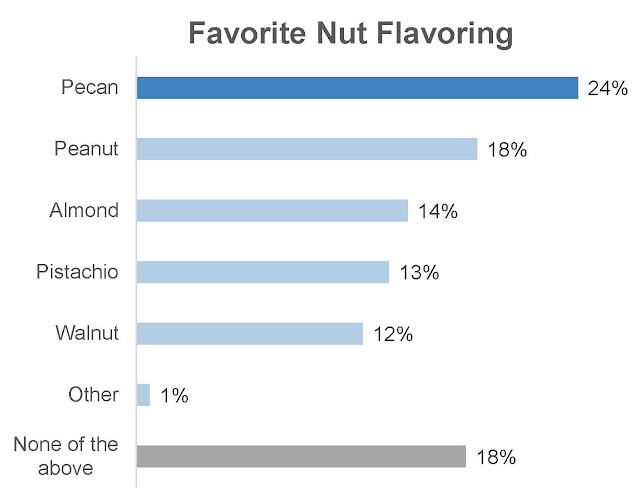

That brings us to my next observation. Shoppers are nuts for peanuts.

The Best in Sweet Snacks went to The Hershey Company for its new Reese’s Snack Bar. And, peanut butter was the star of a new range of sweet snacks from Loacker, New York. All of the varieties are made with 17% real peanut butter in every serving. They are described as being low in sugar but high in flavor, making it a better-for-you treat. Varieties are Quadratini Peanut Butter, a bite size snack in a sharing pack that boasts five light, crispy wafers, enriched with a pinch of cocoa and four layers of peanut butter cream filling. The Classic Wafers Line, which is an individually wrapped on-the-go snack, features three crispy wafers enhanced with a dash of cocoa and two layers of peanut cream filling. Tortina Peanut Butter is an individually wrapped premium snack that’s perfect for the “me-moment” featuring peanut butter cream covered in milk chocolate.

OBSERVATION #2: Consumers crave peanut butter in any way, shape or form. It is one of the few nuts and legumes not being milked—yet—and it goes great with dairy. It can be creamy, crunchy and even provide a crackling pop.

There’s a new commercial peanut butter ingredient available to ice cream innovators from Wonder Natural Foods, the company behind the Better’n Peanut Butter brand. It’s a lower-calorie, lower-fat peanut butter ingredient that also is easier to manage on the production floor. It is produced using a patented formula and process and is now available in large, pumpable aseptic totes.

“The calorie content per serving of our Better ‘n Peanut Butter is only 100 calories in comparison to traditional peanut butter, which usually contain around 200 calories per serving,” said Scott Cuppari, president and CEO of Wonder Natural Foods. “In addition, we have also been able to significantly lower the fat content from approximately 16 grams of fat in most regular peanut butter brands to just 2.5 grams.”

This allows for application in better-for-you ice cream products, including novelties, where direct peanut butter addition can be challenging.

“Traditional peanut butter is oil based, which is difficult to mix with dairy products, therefore ice cream manufacturers tend to use powder-based or peanut butter flavorings instead of the real thing,” said Cuppari. “Our solution is water based. That means that our peanut butter can be fully emulsified in ice cream and dairy products. This water-based formulation is a game changer for the dairy industry.

“This is important for the category as peanut butter continues to be a popular ingredient with consumers and it means that dairy brands can include real peanut butter in their products instead of powders or flavors,” he said.

OBSERVATION #3: Let’s just jump into the next trend, something powders and flavors cannot do in any food application. That is emphasizing texture. It’s been said for some time that texture is one of the most underdeveloped sensory experiences in ice cream. It’s not enough to be creamy any more. Descriptors such as “airy,” “puffy,” “chewy,” “soft” and “squishy” are being used to differentiate in the sweets and snacks categories. There’s opportunities for this differentiation in frozen desserts, too.

OBSERVATION #4: Salt is not just one of the basic tastes. It has evolved into a flavor. This is not new news, after all, we are still living in the sea salt caramel craze that started about a decade ago. But it is expanding and being emphasized.

“Salt” is expected to be a growing flavor trend across all food and beverage, according to Lizzy Freier, menu research and insights, Technomic, Chicago. Salt has become the focal point of flavor innovations.

OBSERVATION #5: There’s no way anyone could not notice that heat is hot. Innovators are exploring intense flavor combinations that include spicy heat, often times calling out the pepper varietal. Some use descriptors such as “inferno” to caution on the heat intensity.

There’s opportunity for heat in ice cream. Think hot honey, spicy mango and peppery peanut butter.

“At

INNODELICE, we are building a varied portfolio of suppliers within the frozen dessert industry so that all of our ecosystem partners have plenty of ingredients and products to choose from when looking to build and expand upon their own portfolios and product ranges,” said Montreuil. “One of these suppliers is Wonder Natural Foods. The company’s new peanut butter variegate comes in several flavors, with more on the way.”

How Do You Milk a Microbe?

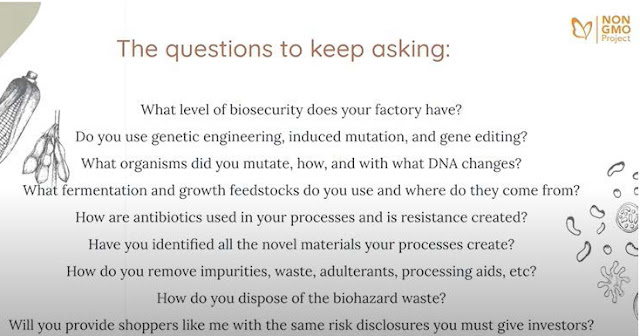

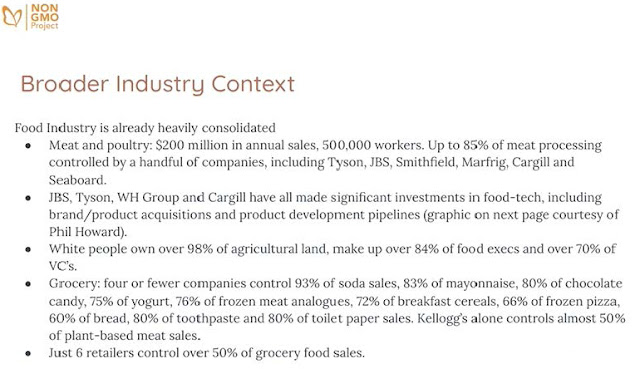

During June Dairy Month, the Non-GMO Project joins American dairy farmers in calling out synthetic dairy, which is quietly appearing in grocery store coolers throughout North America. In recent years, “animal-free” dairy proteins have found their way into everything from ice cream to cream cheese to snack bars, but many shoppers, food manufacturers and retailers are unaware that these are actually unlabeled and unregulated GMOs.

“Synbio dairy products are GMOs because they are created by genetically engineering a microbe like yeast to excrete milk proteins,” said Megan Westgate, founder and executive director of the Non-GMO Project. “That’s the definition of unnatural.”

The synbio process forces cells to produce novel proteins that mimic natural ingredients like casein and whey. The possible risks include:

- Significant biohazardous waste.

- The accidental release of new GMOs into the environment.

- Continued reliance on fossil fuels for GMO growth media and the incineration of waste.

- Synbio dairy could also put traditional dairy farmers and farmworkers out of business.

The synbio dairy industry is rapidly expanding with a significant infusion of investment. According to the biotech industry’s Good Food Institute, nearly $2 billion has been invested in developing “precision fermented” products like synbio dairy in the past year alone.

“GMOs pose a threat to the land, environment, and family farms, and I don’t think GMOs have a place in our farming and food system,” said Albert Straus, founder and CEO of Straus Family Creamery. “As the first Non-GMO Project Verified Creamery in North America, we are committed to organic farming.

“Organic farming practices protect the environment, address animal welfare, build soil health and provide nutritious food while revitalizing rural communities,” Strauss said. “Organic dairy farming and milk production are the foundation for a carbon-neutral dairy farming model that we’ll achieve on my farm by 2023.”

The Non-GMO Project is launching a first-ever, dairy-focused campaign during National Dairy Month to bring awareness to the agricultural and environmental threat of synbio dairy. An industry webinar, consumer education, and media kit for brands and retailers will support the June campaign, “How Do You Milk a Microbe?” The campaign asserts that natural, organic and non-GMO dairy is better than synbio dairy for consumers, farmers and the planet.

Register

HERE for the June 16th webinar taking place at 10am PST.

The Real California Milk (RCM) Excelerator

The California Milk Advisory Board’s (CMAB) annual dairy innovation competition—the Real California Milk (RCM) Excelerator—is ready for applications. Created in partnership with innovation consultancy VentureFuel, this year marks the fourth installment of the competition. This year’s event focuses on accelerating ANY dairy-based product, from traditional consumer food and beverage items to textiles, haircare and beyond. The competition will award up to $500,000 in prizes for new innovative dairy products that introduce novel benefits in any form and drive consumption of Real California dairy.

As one of the biggest dairy competitions in the world, the program seeks early-stage, high-growth potential applicants with a 50% cow’s milk-based product or working prototype. Up to eight applicants will be selected to join the RCM Excelerator program. Each will have access to a group stipend and a robust network of resources to refine and scale their product and business. They will also participate in the CMAB/VentureFuel Mentorship Program, consisting of elite counsel from successful founders, investors, leading corporate executives and experts across design, marketing, sales, manufacturing, distribution, farming and processing industries.

For more information, link

HERE. The deadline to apply is July 17, 2022.

.jpg)